Development and impact of e-wallets on the iGaming economy

In the pulsating arena of digital entertainment, iGaming has risen to prominence as an incredibly innovative and fiercely competitive industry. As it experiences significant growth, businesses are leveraging modern technologies, such as online casinos, sports betting platforms, poker apps, and lotteries, to captivate their clients and remain competitive.

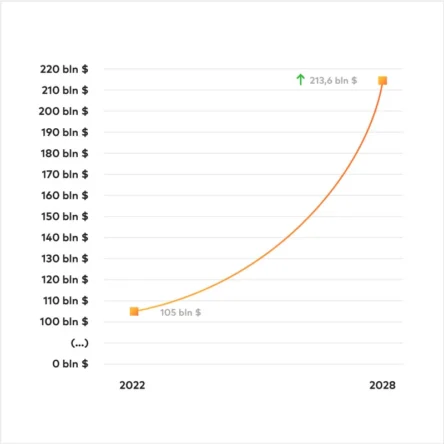

With market projections from Research & Markets suggesting a noteworthy surge in the industry’s value to over $213 billion from 2022 to 2028, businesses are pushing the envelope to provide the most user-friendly solutions. Key elements of focus include enhancing entertainment quality, ensuring anytime-anywhere availability, optimizing UX/UI design, and bolstering security.

At the heart of these improvements, particularly in the context of smooth and secure transactions, is the rise of digital wallets. Despite the traditional dominance of credit and debit card payments, the online gambling community is gravitating towards e-wallets. These digital payment solutions offer convenience and enhanced security measures, contributing towards more efficient and worry-free gaming experiences.

An array of e-wallets with slightly varied features is being integrated into iGaming platforms to improve customer experiences significantly. So, what is an e-wallet and how does its integration enrich iGaming applications? This journey explores the increasing role of digital wallets in iGaming and how they are transforming the dynamics of online transactions in this booming industry.

Understanding digital wallets

E-wallet will not only streamline online transactions but optimize user experience in online iGaming environments by enabling swift and secure money transfers, deposits, withdrawals, and bets. The integration of numerous game providers will be enabled through a single facade using a strategy pattern. The integration of numerous game providers will be facilitated through a single facade employing a strategy pattern. This idea is based on two fundamental design patterns:

- facade is a structural pattern that provides a unified interface to a set of interfaces in a system. The Facade defines a higher-level interface that makes the subsystem easier to use.

- strategy is a pattern that allows a family of algorithms to be defined, which are interchangeable and can be selected during the runtime of the program. It allows the behavior of an application to change based on context.

Every type of incoming transaction – be it a bet, win, or simple money transfer – will be treated uniformly, ensuring seamless control over the wallet’s functioning. All transactions should be chronicled as a series of events in an event store, emphasizing data transparency and traceability. The current balance amounts including real, bonus, withdrawable, and non-withdrawable amounts, will be calculated and updated with each transaction.

Enhanced data privacy with e-wallets

Stepping up from conventionally dominant payment methods like credit cards, digital wallets exhibit a leading edge due to their superior data privacy attribute. The users can perform transactions without sharing personal details with vendors, enhancing the security quotient. The wallet will also ensure user protection by keeping track of periodic or game session limits, preventing them from exceeding set boundaries. This vigilant supervision of every transaction will contribute towards safe and responsible gaming.

Swift transactions in online casinos

With the rise of online casinos, the need for speed in transactions is paramount. Digital wallets have come to the rescue, enabling lightning-fast transactions and kick-starting gaming activities within minutes.

Several online casinos are stepping up their game by integrating digital wallets that guarantee faster withdrawal processes. Users can access their winnings without facing unnecessary delays, enhancing their overall gaming experience. Some digital wallets take this a step further, offering debit card functionality, making it possible to withdraw cash from ATMs globally.

Beyond simply quick transactions, digital wallets enhance user engagement in online casinos. The wallet generates asynchronous events processed by a queue which doesn’t require immediate handling. Using an asynchronous approach doesn’t necessarily mean a delay of several seconds. More often, the delay is only a fraction of a second, although this can vary depending on the current load on the system. For actions such as awarding a bonus or displaying a notification, the system can manage a few seconds of delay without interference because the gameplay is running uninterrupted during this time.

Batch processes such as assigning experience or loyalty points, dispensing bonuses, and flashing alerts when nearing limit can be activated—enhancing system performance without impacting the user’s gaming experience. By adopting a batch processing approach, not only does it assist in maintaining system performance, but it also ensures an improved gaming experience.

Distinguishing between digital and mobile wallets

Despite the terms digital wallets and mobile wallet soften being utilized interchangeably, there exists a subtle distinction. A mobile wallet serves as a subset of the digital wallet realm. It could manifest either as an inherent function on cell phones or a downloadable application.

Surpassing the constraints of physical wallets cluttered with cards, mobile wallets like PayPal, Google Pay, Apple Pay, Samsung Pay, and Venmo, bring convenience to your fingertips. They hold a vast range of elements, from credit and debit cards, gift cards to even coupons, making them versatile for both physical and digital shopping experiences.

The security advantage of mobile wallets

These mobile-based platforms come fortified with built-in security safeguards to shield them from fraudulent activities, hence providing a more secure solution than their physical counterparts. The growing acceptance of mobile wallet payments across businesses is driving a shift towards a cashless society.

Unpacking the core attributes of digital wallets

To help you understand how digital wallets work, let’s delve into some hallmark features that add to their functionality — tokenisation, NFC technology, biometric authentication, and cloud-based.

The role of tokenization

Tokenization is a crucial security element in digital wallets which substitutes sensitive data, such as credit card numbers, with a unique token identifier. This identifier, or token, holds no intrinsic value rendering it useless in case of a breach. Social security breaches are mitigated since each purchase you make via a digital wallet gets assigned a unique token, keeping your actual credit card number concealed. Thus, even if a malicious party attempted to gain access, they would only retrieve a random token, not your card details.

The power of NFC technology

Another fundamental attribute of digital wallets is the incorporation of NFC – Near Field Communication technology. NFC facilitates contactless interactions between devices in close vicinity, enabling users to make payments by simply tapping their mobiles or cards near compatible payment machines. Introduced around 2010, this feature has been widely embraced, making contactless payments a norm rather than an exception.

Strengthening security with biometric authentication

Increased security is of paramount importance due to the rising usage of digital wallets, projected to hit 5.2 billion users come 2026. To bolster the security front and offer an additional layer of authentication, digital wallets now utilize biometric verification – like fingerprint scans or facial recognition. This harnesses the user’s unique physiological traits, reducing friction while enhancing security.

Optimizing cloud-based storage

Many digital wallets employ cloud-based storage to synchronize payment details across various devices securely. As opposed to saving sensitive information directly on your device, employing cloud storage is akin to having a secure virtual safe for your payment data. Users can access their payment methods from multiple devices, reassuring them of the safety of their data even if they misplace or lose their device.

Emergence of crypto wallets

A unique progression in the domain of digital wallets in the recent era is the creation of crypto wallets. Developed explicitly to cater to cryptocurrency transactions and management, crypto wallets have become a cornerstone for those navigating the intriguing world of blockchain and digital assets.

Crypto wallets offer the capacity to house a diverse range of digital currencies—from leading ones like Bitcoin and Ethereum to the increasingly backed altcoins. Their ability to provide safe storage, simple access, and secure cryptocurrency transactions has made them a crucial asset for participants in the burgeoning blockchain ecosystem.

Travelling e-wallets

The realm of iGaming has recently welcomed a new technological marvel known as the travelling e-wallet. This concept is stirring significant interest within the market due to its unique ability to maintain a balance in gamers’ digital wallets, even as they traverse regions where funding a gaming account is disallowed.

If you are moving through a country where betting or cryptocurrency gaming is prohibited, you won’t be able to recharge your casino wallet; otherwise, it will be regarded as breaking the law. The travelling wallet feature takes away from the stress of transferring funds acting as a hall pass.

But the biggest catch here is that a travelling wallet complies with all the standards of gambling regulations. The wallet is also enabled with a feature that can keep track of all the background transfers in terms of location, keeping the activities lawful. This fuels engagement and there’s nothing better for your iGaming business than having happy customers!

iGaming market changes

iGaming has steadily gained considerable momentum over the years. More and more users are now indulging in online gaming via their handheld devices, marking a significant rise in the iGaming industry’s growth. A considerable part of this industry’s earnings are now attributed to mobile platforms.

Statista wrote that the revenue generated from the online gambling market is forecasted to hit USD 100.90 billion in 2024. Following this trend, with an anticipated annual growth rate (CAGR) of 6.20% from 2024 to 2029, the market volume could reach an impressive USD 136.30 billion by 2029.

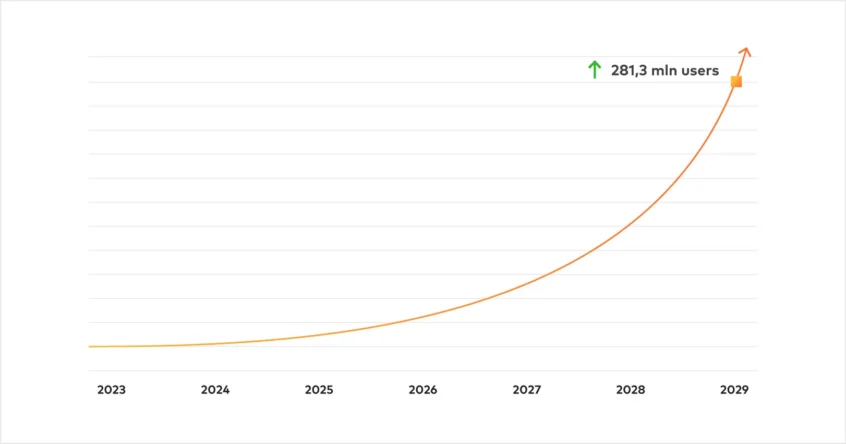

In terms of user numbers in the online gambling market, projections indicate that it could rise to 281.3 million users by 2029. User penetration, which stands at 6.0% in 2024, is also expected to increase, potentially reaching 7.6% by 2029.

Meanwhile, the average revenue accrued per user (ARPU) is likely to stand at approximately USD 470.

There are noted geographic disparities in the market as well. The United States is set to generate most of the revenue in this sector – USD 23.03 billion in 2024. In terms of user penetration, Canada rules the market with a high projected rate of 69.4% in online gambling engagement.

Payment orchestration

Payment orchestration is a transformative approach to managing all aspects of financial transactions, including payment authorization, transaction routing, and settlements. This end-to-end integration increases the agility and scalability of businesses, enabling them to swiftly adapt to new markets, support multiple currencies, seamlessly integrate with various regional payment providers, and yet remain compliant with pertinent regulations.

Payment orchestration platforms

Payment orchestration platforms (POP) function as a one-stop control panel for managing payment service providers, acquirers, applications, and banks. Businesses can simultaneously manage and monitor various payment platforms.

POP manifests itself in two different varieties. One is purely backend technology, which oversees the routing of transactions between providers. The other combines unified backend and frontend technology to facilitate a user-friendly checkout experience, while ensuring optimal routing of transactions for high authorization rates and cost savings.

Payment orchestration process step by step:

- a customer chooses a product or service and adds it to their shopping cart before proceeding to checkout,

- at this stage, the customer selects their preferred payment method and provides the relevant payment details through the payment gateway,

- next, the payment gateway secures the customer’s payment information by encrypting it. This encrypted data is then transmitted to the acquiring bank via the payment processor,

- after receiving the encrypted data, the acquiring bank communicates with the issuing bank. The goal of this interaction is to verify the payment information and authorize the transaction,

- normally, the acquiring bank sends back an authorization or failure message to both the payment gateway and the merchant. But with a payment orchestration platform, if a payment fails, the platform will automatically relay the same payment order to a different payment processor. This process aims to reduce the number of false declines,

- in case the payment request is approved by the other payment processor, the initial transaction is considered successful. Overall, payment orchestration platforms streamline the payment process by employing intelligent routing to guarantee optimal authorization rates and minimize costs.

Use of PCI Level 1 compliant vaults with Cross-PSP tokens

Earning customers’ trust depends largely on the level of payment processing security. One method used by many companies is Payment Card Industry (PCI) Level 1 compliant vaulting, which is known for securely storing key payment data using tokens. This not only protects customers’ card information but also complies with strict PCI standards. An important advantage of this vault is its interoperability with multiple payment service providers. This provides a seamless integration process and allows companies to handle payments securely without having to disclose sensitive information or maintain separate vaults.

Conclusions

Fascinated by the transformative potential of digital wallets, including mobile wallets, crypto wallets and groundbreaking travelling wallets, in the realm of iGaming? Enhance your understanding of these innovative tools as they pave the way for the industry’s future. Get in touch with our team of global experts who are at the forefront of these developments.