iGaming business successes in Africa

The African iGaming business has grown fast, especially over the last few years. Increased internet access, greater usage of smartphones, and partial liberalization of legislative restrictions on gambling created an enabling environment for such growth in several African countries. The iGaming business is growing, with countries like Nigeria, Kenya, and South Africa included among those most involved in the African market. This has opened new opportunities both for operators and investors, marking Africa’s iGaming industry as the hotbed of global expansion.

Key drivers of iGaming growth in Africa

- mobile phones are more accessible than conventional computers, so most African consumers are using mobile iGaming platforms,

- although casino regulations remain largely in the development stage in most African countries, others, such as South Africa, have tried to pick up the pace with a little more clarity on the rules, thus encouraging responsible iGaming business operations,

- A major factor contributing to such great success for iGaming is sports betting, which is an increasingly popular activity in many African countries, particularly Nigeria and Kenya.

Opportunities for the iGaming business in Africa

- untapped market potential – at present, most African nations are still in the development phase for iGaming industries; therefore, there is great potential for early entrants,

- larger client database – Africa is viewed as the future destination for iGaming growth, as the young population increases with access to more digital services,

- innovative payment solutions – with increased usage of mobile money platforms such as M-Pesa in Kenya, it is very easy for operators to integrate means of payment specifically customized for the local market.

Challenges in the African iGaming industry

- regulatory uncertainty – despite the prospect, online gambling regulation across different countries in Africa forces operators to be very discreet, since different nations hold different views on the issue. Many places are yet to issue proper direction on this,

- infrastructure limitation – even though more and more people get access to the internet, there are huge geographical limitations to access which may always hamper the reach of an iGaming platform,

- payment integration issues – as mobile payments grow, a section of the population remains rudimentary with traditional banking services, therefore standing in the way of participating in online gambling activities.

The iGaming industry in South Africa

South Africa is among the biggest markets in online gaming around Africa. It has, probably, the most progressive legal framework in gambling from an African perspective, hence central to iGaming operators. The foundational framework for online gambling South Africa legal regulations is provided by the National Gambling Act of 2004. While sports wagering is completely legal and regulated under the National Gambling Act of 2004, online casinos, along with other forms of iGaming, have not been legalized to this date. Also, the National Gambling Amendment Act of 2008 was supposed to come into place with regulations concerning online casinos and interactive gambling, but it has not been enacted yet, which leaves much of the industry in a gray area. However, with new developments such as the Remote Gambling Bill of 2024, this is bound to change. It gives a legal framework for online gambling, including online casinos. The new bill may thus make provisions for full legalization and regulation.

Popular forms of online gambling in South Africa

- sports betting – sport, above all soccer, is a national passion; therefore, it is not surprising that this sector dominates the South African iGaming landscape,

- lotteries and sweepstakes – have a huge following, and many have transitioned to purchasing lottery tickets and entering sweepstakes through online websites,

- casino games – at present, these are not yet fully regulated, but there does seem to be an increasing interest in online casino gaming by players within South Africa.

Key trends in the South African iGaming market

- mobile-first approach – just like the greater part of the continent, the greater number of iGaming transactions in South Africa occurs through mobile devices. This continues to impact how new gaming sites are being developed,

- regulatory developments – there are continued talks on further expanding the current legal scope of online gambling, especially about bringing online casinos to an end. This could give a major fillip to the iGaming business in the country if successful.

iGaming Africa – A continental perspective

The growth of the iGaming industry is uneven across Africa, with different countries being at varied stages of development. What follows is a rough sketch of what the landscape currently looks and feels like in various regions:

- West Africa – countries such as Nigeria and Ghana are becoming key markets for iGaming, particularly from a sports betting perspective.

- East Africa – Kenya leads the pack in the region, mainly due to powerful mobile telephone payment systems that lay the foundation for online gambling.

- Southern Africa – South Africa remains the flagship market, with other countries such as Zambia and Namibia starting to grow.

The importance of player retention strategies in African casinos

Competing fiercely among many rivals within the iGaming industry, most online casinos, especially those operating on African soil, fail to be in tune with one crucial cornerstone – player retention. New player acquisition is indeed vital, but retaining customers takes an equal place in long-term success. A strong player retention approach could substantially affect a casino’s profitability and growth.

Common oversights in African casinos

There are numerous casinos in Africa whose main activities are recruiting new customers, but keeping them is not fully planned. Many casinos don’t pay the necessary attention to such things as:

- personalisation – offers and correspondence are meant to be customised to every player in order to suit his needs for better game engagement,

- loyalty programs – a good loyalty scheme inspires repetition, but many casinos across Africa have totally failed to employ strong programs.,

- customer feedback – not listening to players may mean opportunities are missed to improvise and innovate. They should be very much involved in a dialogue so casinos can understand their needs.

For more detailed insights into building an effective player retention strategy, check out our player retention strategy program.

Insights from the iGaming success stories report

This report will give you an idea of how to win against the competition and attract the most players in the trillion-dollar market. In this report, we focus on analyzing specific online casinos, making hypotheses, and uncovering the secrets of their success. All based on external, commercial analytical tools, the report provides not only reliable data but also their interpretations for business strategies.

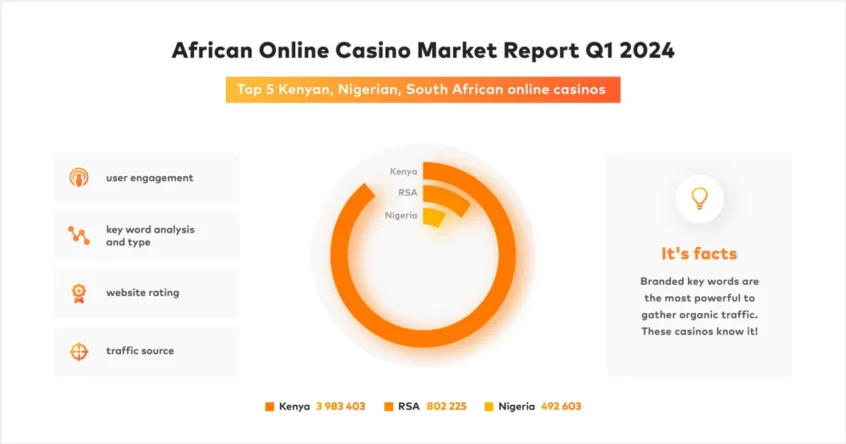

The document is divided into 3 meticulously planned sections and is based on the analysis of 5 online casinos operating in the respective markets (South Africa, Nigeria, Kenya) with the highest organic local traffic in the first quarter of 2024. The main goal of the report is to interpret the visibility data on the internet and its correlation with actual player acquisition. Each region is discussed separately but based on the same methodology and data architecture, which looks as follows:

The Big Five at a glance

- Overview & perspectives

- Local brand strength and penetration

- User’s engagement

- Keyword analysis

Main conclusions

Despite SEO optimization at a very high level, casinos are still rated at 50 out of 100 in reports indicating player experiences. 45-55% of organic traffic comes from thematically related websites focused on iGaming and betting. The strength of the brand and the association of the casino brand with trending games are the main sources of organic traffic.

The first market report analyzing the visibility of online casinos on the Internet will be available on 08.05. 2024